Good morning and welcome to the Hodl Report

Someone hit the red button, and this time it wasn’t a fat-fingered whale. While we were busy meme-ing our way through another “bullish” Monday, the market tanked like it was 2022 all over again—only this time, it smelled...coordinated. We’re diving into the who, how, and what-the-hell of this month’s mysterious mega-dump. Oh, and in the Editor’s Corner we are writing a eulogy for WAGMI that hits uncomfortably close to home.

Institutional-Grade Opportunities for HNW Investors

Long Angle is a private, vetted community connecting high-net-worth entrepreneurs and executives with institutional-grade alternative investments. No membership fees.

Access top-tier opportunities across private equity, credit, search funds, litigation finance, energy, hedge funds, and secondaries. Leverage collective expertise and scale for better terms.

Invest alongside pensions, endowments, and family offices. With $100M+ invested annually, secure preferential terms unavailable to individual investors.

Editors Corner

🙃 WAGMI Is Dead. Long Live WGMI (We’re Gonna Maybe It.)

Remember when everyone used to yell WAGMI!?

Like, every tweet, every Discord, every NFT project intro — pure delusional optimism.

“We’re all gonna make it!”

Fast-forward to now and… well, half of us didn’t.

What started as a rallying cry has turned into something between a meme and a coping mechanism. The truth is, we’re not all gonna make it. Some of us are gonna get rugged. Some will sell the bottom. Some will quit, become realtors, and swear they were “never that into crypto anyway.”

And that’s okay. Because “making it” was never about a number. It was about surviving long enough to see the next cycle.

WAGMI was born in a bull market. WGMI — We’re Gonna Maybe It — is forged in a bear. It’s quieter. Humble. A little bruised. It doesn’t need laser eyes or moon emojis. It just needs conviction, curiosity, and enough caffeine to not rage-sell your stack.

So yeah, WAGMI might be dead.

But WGMI? That’s real. It’s the belief that maybe — just maybe — we keep showing up, keep learning, keep building, and one day we’ll look back and realize…

We actually did make it. Just not the way we expected.

Crypto Trivia: Quadriga’s Vanishing CEO

Like Moneyball for Stocks

The data that actually moves markets:

Congressional Trades: Pelosi up 178% on TEM options

Reddit Sentiment: 3,968% increase in DOOR mentions before 530% in gains

Plus hiring data, web traffic, and employee outlook

While you analyze earnings reports, professionals track alternative data.

What if you had access to all of it?

Every week, AltIndex’s AI model factors millions of alt data points into its stock picks.

We’ve teamed up with them to give our readers free access for a limited time.

The next big winner is already moving.

Past performance does not guarantee future results. Investing involves risk including possible loss of principal.

Today’s Report

Who Crashed Crypto? The Coordinated Crash No One Saw Coming

🚨 Our Report

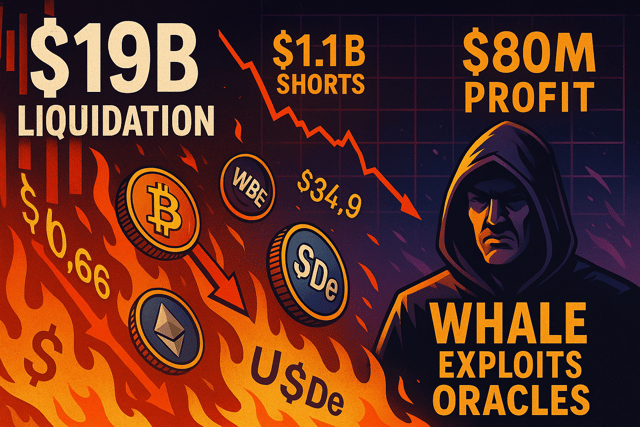

The crypto world was given a rude awakening on Oct. 10–11 when some $19.3 billion in positions hit the chopping block in mere hours — the largest liquidation event in crypto history. What looked like panic turned out to be far more surgical: a ~$60 million spot dump reportedly triggered a cascade via a manipulated price oracle, decimating leveraged positions across the board. A single whale is believed to have held ~$1.1 billion in short positions and profited more than $80 million in 24 hours. The alleged attack didn’t come from stolen keys or a hack—it came from exploiting the plumbing of the system itself.

🔓 Key Points

A single exchange saw dramatic price drops in three assets — USDe crashed to ~$0.66, wBETH plunged 89% below ETH value, and BNSOL tumbled to ~$34.9 — while other venues remained relatively stable.

The timing was too perfectly aligned: a vulnerability window was publicly announced by Binance on October 6 for oracle changes to these assets, scheduled for Oct. 14 — the dump happened Oct. 10‑11.

The attack reportedly followed the blueprint: manipulate an oracle reliant on one venue’s spot price, trigger liquidations, and profit massively with leveraged shorts. This has been done before — now just at institutional scale.

The suspected whale: a trader linked via on‑chain sleuthing to the name Garrett Jin (aka Garrett Bullish), with past ties to exotic exchanges and major holdings. While not formally accused, the positioning and signatures raised eyebrow-high suspicion.

Key systemic failures: Over‑reliance on a single source for oracles; announcing changes in advance which gave attackers the planning window; infrastructure that collapsed under stress when markets moved fast.

🔐 Relevance

If this wasn’t just a freak market move, but a fully coordinated exploitation of market structure, then we’re entering a new era of “attack surface” for the crypto markets. The plumbing — not the coins — just became the weapon. For savvy investors, this means: risk isn’t just volatility — it’s architecture. All those yield programs, leveraged positions, oracle‑dependencies — they’re ripe for manipulation. The fact that one $60 million dump could knock out $19.3 billion in value shows how fragile the system remains. This wasn’t a bug; it was a feature of the design.

Market watchers should treat every major oracle change, exchange upgrade, or big leveraged position as a potential point of failure. The typical “sell the news” panic narrative is losing relevance when the narrative is “someone lined up the rails and let the train crash intentionally.” Traders anchoring their strategies on systemic safety must wake up: the floors are still brittle. If you’re holding highly leveraged positions or depending on collateral whose pricing comes from a vulnerable source — you don’t have an edge, you’re a target.

Bottom line: This is more than a crash. It’s a warning that until protocol designers stop treating oracles like an afterthought, the next $x billion cascade could be just a smarter button‑push away.

Get in on the markets before tech stocks keep rising

Online stockbrokers have become the go-to way for most people to invest, especially as markets remain volatile and tech stocks keep driving headlines. With just a few taps on an app, everyday investors can trade stocks, ETFs, or even fractional shares—something that used to be limited to Wall Street pros. Check out Money’s list of top-rated online stock brokerages and start investing today!

Today’s Top News

HEADLINES

Crypto Market Crash on Oct 10–11 Hits New Record Drop — Bitcoin fell over 14% in a single day, marking the largest 24-hour drop in crypto history. Panic liquidations and cascading sell-offs wiped out billions in value. Analysts now fear systemic risks in unregulated crypto derivatives.

North Korea-Linked Hackers Embed Malware in Smart Contracts — AAPT researchers found North Korean group UNC5342 using “EtherHiding” to place malware in smart contracts. These stealthy exploits are almost impossible to detect or remove without major chain-level interventions. This tactic threatens to undermine smart contract trust globally.

Coinbase Acquires Token-Sale Platform Echo for $375 Million — Coinbase purchased Echo in a major pivot to own token-launch infrastructure. The acquisition will let users launch tokens and raise funds directly within the Coinbase ecosystem. Analysts see this as a strike at Ethereum-native platforms like CoinList.

Crypto Startup Funding Hits $530M in a Week — Thirty-two crypto startups raised over half a billion dollars between October 19–25. The funding surge included DeFi, AI-integrated chains, and cross-chain privacy layers. It signals VC confidence despite recent market instability.

Market Trendline

PRICE ACTION

After a short pause, the crypto market is showing signs of awakening. The overall market cap is hovering around the ~$3.9 trillion mark and trading volumes remain elevated. Bitcoin reclaimed the ~$115 000 level, signaling renewed risk appetite. At the same time, sentiment appears cautiously optimistic rather than euphoric.

Notable Movers

Bitcoin (BTC): Jumped above ~$115 000 in the past 24 hours, up over 3 %. The move seems tied to easing macro jitters—trade optimism between the U.S. and China getting cited often.

Ethereum (ETH): Up about +2–3 % to ~$4 160. This is a solid follow‑through move, though less explosive than some altcoins.

Solana (SOL): A standout in the alt‑coin cohort. Trading above ~$200 (~3–4 %+ on the day) with commentary pointing to rising on‑chain activity and institutional interest — those are not just retail pumps.

Smaller tokens / gainers list: A few lesser‑known tokens popped into the leaderboards with double‑digit gains, but many of those remain very speculative and low volume.

Macro View

The rebound feels more than just a short squeeze:

Trade‑relations developments seem to be improving, helping the “risk‑on” backdrop.

Crypto leverage liquidations earlier this month still weigh heavily; this bounce may be the “clean‑up” leg of that.

On‑chain signals (especially for Solana) are suggesting institutional interest is creeping back in rather than purely retail hype.

That said: the move lacks conviction in some quarters. The big resistance‑zones (~$120k for BTC, ~$230 for SOL) remain untested.

Bottom Line

The market’s shaking off its recent trough and risk is creeping back in. Bitcoin reclaiming ~$115 k and Solana showing strength are encouraging signals — but this isn’t a runaway bull phase yet. Consider this a cautiously positive rebuild rather than full‑tilt momentum.

How'd I do this week?

Are you a crypto trader?

I have two products designed to help traders. Check them out if you are looking for an edge or just to learn to become a more successful trader!

You made it to the bottom, congrats! I really appreciate you reading. If you enjoyed today’s content please share it with a friend and if you aren’t already subscribed please do!

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.