Good morning and welcome to the Hodl Report

If you told me in 2021 that the future of crypto hinged on accounting practices and courtroom confessions, I’d have asked what chain you were smoking. Yet here we are—talking Treasury coin strategies and watching Do Kwon finally utter “guilty” after vaporizing $40B in the Luna collapse. It's less moon, more mea culpa this week.

Today’s Report

From Moonshots to Balance Sheets: The Treasury Coin Era

If you want to know which assets will still be standing in five years, stop looking at retail hype and start following corporate treasuries.

We’ve entered a new phase where public companies, private funds, and even DAOs are stacking BTC, ETH, and a handful of “boardroom-approved” alts. These aren’t YOLO trades—they’re strategic balance sheet moves. Why?

Liquidity – Big treasuries need assets they can move in size without nuking the price.

Regulatory Cover – BTC and ETH have effectively been knighted as “safe enough” by the market and, in ETH’s case, Wall Street plumbing.

Yield Potential – Staking ETH or running BTC yield strategies can turn a static asset into a revenue generator.

The effect? These coins are quietly morphing into wall street blue chips not just crypto blue chips—behaving less like speculative tokens and more like corporate-grade assets. That doesn’t mean they’re immune to volatility, but when a Fortune 500 CFO is wiring $50M into a coin, the odds of it going to zero get a lot smaller.

So while everyone’s trying to 10x on the next microcap degen play, the real money is quietly consolidating into a short list of treasury-grade assets. And in a market that still runs on sentiment, nothing builds confidence like seeing your bag in a quarterly earnings report.

Today’s Report

Crypto Kingpin Do Kwon Finally Cracks Pleading Guilty in $40B Collapse

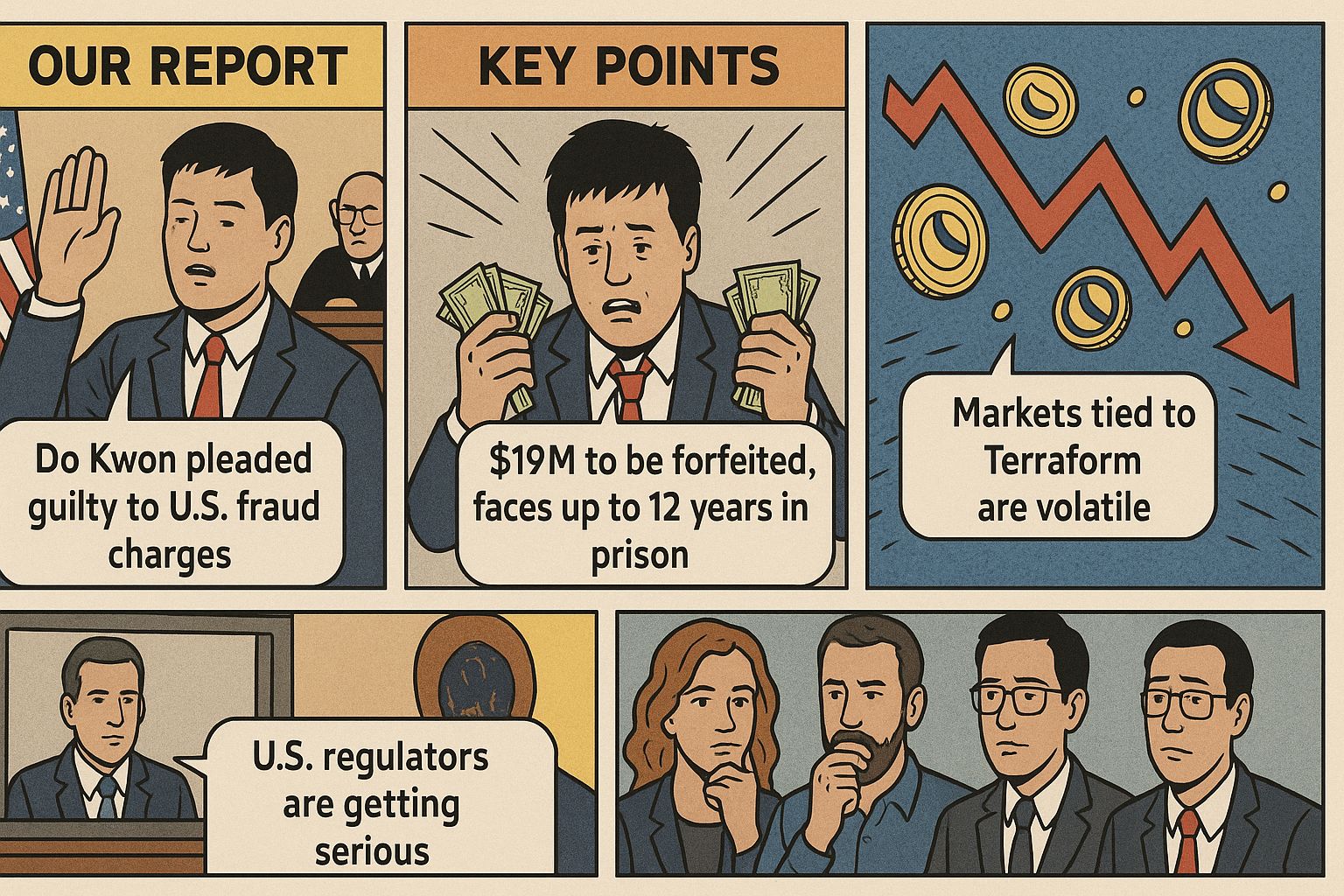

Our Report

Do Kwon, the now-disgraced architect behind the explosive collapse of TerraUSD and Luna, has officially pled guilty to U.S. fraud charges. Turns out, the $40 billion implosion wasn't just a glitch—it was a crime. As part of the deal, he’ll hand over roughly $19 million and faces up to 12 years behind bars. The plea is a landmark moment, not just for Terra fans but for all crypto speculators: U.S. regulators are getting serious. Welcome to the new era of accountability.

Key Points

Do Kwon pleaded guilty to two counts of fraud in U.S. federal court—no slippery denials this time.

The legal agreement includes forfeiture of about $19 million and caps sentencing at a 12-year max.

This marks one of the first major criminal convictions of a crypto founder in U.S. history.

Markets tied to Terraform—especially LUNA and its variants—now dance nervously to this new legal beat.

The case sets a chilling precedent: crypto is no longer a lawless frontier.

Relevance

This isn’t just courtroom drama—it’s a signpost. For years, the decentralized wild west of crypto allowed headline-grabbing catastrophes under the guise of innovation. Do Kwon’s guilty plea snaps that narrative: justice can, and will, catch up. Institutional players will be watching closely, recalibrating how they assess regulatory risk before backing any flashy blockchain venture.

For traders and speculators still holding Terra-linked tokens, know this: your assets now carry legal tailwinds. Price action may remain jittery until sentencing in December, when a clearer penalty—or perhaps cooperation fallout—materializes.

Beyond Terra, the message is stark: U.S. enforcement is flexing its muscles. Crypto firms and founders will need compliance frameworks, legal insiders, and perhaps a thicker skin. Welcome to crypto’s accountability era—let’s see how long it lasts.

Today’s Top News

Headlines

Crypto Founder Do Kwon Pleads Guilty to US Fraud Charges — Terraform Labs co-founder Do Kwon has pleaded guilty to criminal charges in the U.S. tied to the $40 billion collapse of TerraUSD and LUNA. Prosecutors allege Kwon knowingly misled investors about the stability of TerraUSD. This marks a major development in one of crypto’s largest fraud cases.

Partial Mistrial Declared in Tornado Cash Developer Roman Storm’s Case — A federal judge declared a partial mistrial in the high-profile money laundering case against Tornado Cash developer Roman Storm. The jury was deadlocked on several charges related to alleged facilitation of North Korean laundering. This raises questions about legal accountability for open-source crypto developers.

Ex-Crypto CEO Richard Kim Charged in $3.8M Fraud Scheme — Richard Kim, former CEO of a crypto investment platform, has been charged with wire fraud and securities fraud involving $3.8 million in misappropriated investor funds. Authorities say Kim used the funds for personal luxuries and fake returns. The charges reflect ongoing crackdowns on fraudulent crypto executives.

South Korean Prosecutors Seize $2.2M From Terra Insiders Amid New Charges — Authorities in South Korea have seized $2.2 million in assets from Terraform Labs insiders following Do Kwon’s guilty plea. Several former executives are now under fresh investigation for insider trading and embezzlement. The scandal continues to expand beyond Kwon himself.

Crypto Influencer ‘CryptoKid’ Sued for Promoting Fraudulent Tokens — Popular influencer “CryptoKid” faces a class-action lawsuit for allegedly promoting pump-and-dump tokens to followers. Plaintiffs claim he received undisclosed compensation to hype worthless crypto projects. The case highlights growing scrutiny of crypto endorsements on social media.

Market Trendline

Price Action

Well, the crypto market just gave us a wild roller-coaster day: Bitcoin hit a stratospheric new all‑time high around $124K, only to get slapped back down to ~$118K on inflation jitters—and yes, over $1 billion in liquidations poured salt into the wound. Meanwhile, Ethereum flirted with its own record before backing off.

Market Overview

Markets were pretending to be bulls until inflation data reminded everyone they're not. That triggered a cascade of forced sell-offs, pushing BTC down roughly 4–5%, despite its earlier peak above $124,000. ETH followed suit, slipping after a bullish run. Overall, volatility is the WORD of the day.

Notable Movers

Bitcoin (BTC): Danced to a fresh all‑time high (~$124K), then dipped to ~$118K as inflation spoiled the rally and excessive leverage did the rest.

Ethereum (ETH): Touched ~$4,788 before pulling back to near $4,500, undercut by the PPI numbers.

Macro View

Let’s not sugarcoat it: today’s volatility is entirely predictable. Inflation data spooked the Fed‑hopers—so rate‑cut dreams took a hit, dragging crypto with them.

Bottom Line

Crypto had a flashy moment—Bitcoin at $124K—but it didn't stick. Macro backdraft pulled everything down, leveraged positions collapsed, and just like that, enthusiasm turned into forced sales. If you think summer rallies come without consequences, think again. Let’s see if market mood stabilizes—or if this is just the start of back‑and‑forth sidestep.

Today’s Top Meme

Memes are Life

From Italy to a Nasdaq Reservation

How do you follow record-setting success? Get stronger. Take Pacaso. Their real estate co-ownership tech set records in Paris and London in 2024. No surprise. Coldwell Banker says 40% of wealthy Americans plan to buy abroad within a year. So adding 10+ new international destinations, including three in Italy, is big. They even reserved the Nasdaq ticker PCSO.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

How'd I do this week?

Are you a crypto trader?

I have two products designed to help traders. Check them out if you are looking for an edge or just to learn to become a more successful trader!

You made it to the bottom, congrats! I really appreciate you reading. If you enjoyed today’s content please share it with a friend and if you aren’t already subscribed please do!

DISCLAIMER: None of this is financial advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and do your own research.